BITCOIN MARKET UPDATE 24.NOV.2024

Hello and welcome to today’s Bitcoin market update, brought to you by Algo-Fund.com It’s November 24th, 2024, and we’re here to provide you with the latest analysis and insights to help you navigate the markets.As of 05:42 AM GMT+1, Bitcoin is trading at $97,988.

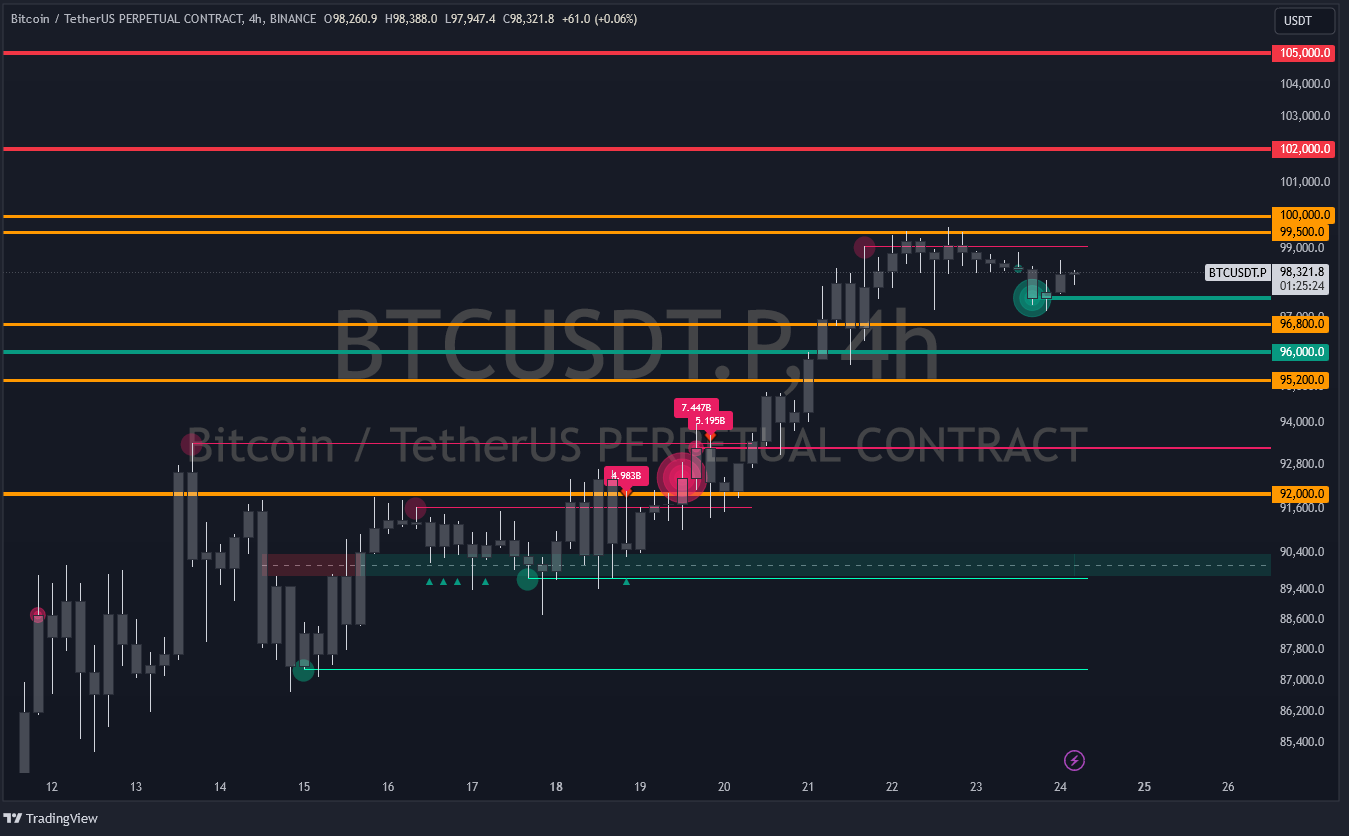

Over the past 24 hours, we’ve seen a consolidation around the $97,500 to $98,500 range after a steady upward trajectory over the last week. The current momentum reflects strong bullish sentiment as Bitcoin approaches psychological resistance at $100,000.On the 4-hour timeframe, our system highlights:Support levels at $96,800 and $95,200, where accumulation has occurred.Resistance at $99,500 and $100,000. Breaking above $100,000 could lead to a significant rally.

On the daily timeframe:The RSI shows overbought conditions, suggesting potential short-term pullbacks.A bullish divergence on the MACD aligns with sustained buying pressure.Our proprietary system, combining Elliott Wave, Pi Cycle analysis, and on-chain data, suggests:We are currently in Wave 3 of a larger Elliott Wave pattern, with projected targets above $102,000 in the short term.Whale activity remains robust, with significant wallet addresses accumulating near $96,000, indicating strong support at this level.On-chain analysis reveals decreasing exchange inflows, signaling reduced sell pressure.

On the weekly timeframe, Bitcoin is in a clear markup phase:The $92,000 zone serves as critical support for any pullbacks.Fibonacci extensions point to $105,000 as the next key target.On the monthly timeframe, the bullish trend remains intact, with no signs of reversal as we head toward the year-end.In summary, today’s outlook for Bitcoin is cautiously bullish. Traders should watch for a breakout above $100,000 for confirmation of the next leg upward, while maintaining caution around potential short-term corrections.

That’s it for today’s market update. Thank you for tuning in! For more insights and updates, visit us at algo-fund.com. Have a profitable trading day!