WEEKLY MARKET UPDATE 25.NOV.2024 part2

Welcome back to our detailed weekly market update brought to you by algo-fund.com.

In this segment, we’ll uncover long-term trends in crypto markets, analyze economic policies shaping the financial landscape, and identify actionable opportunities.

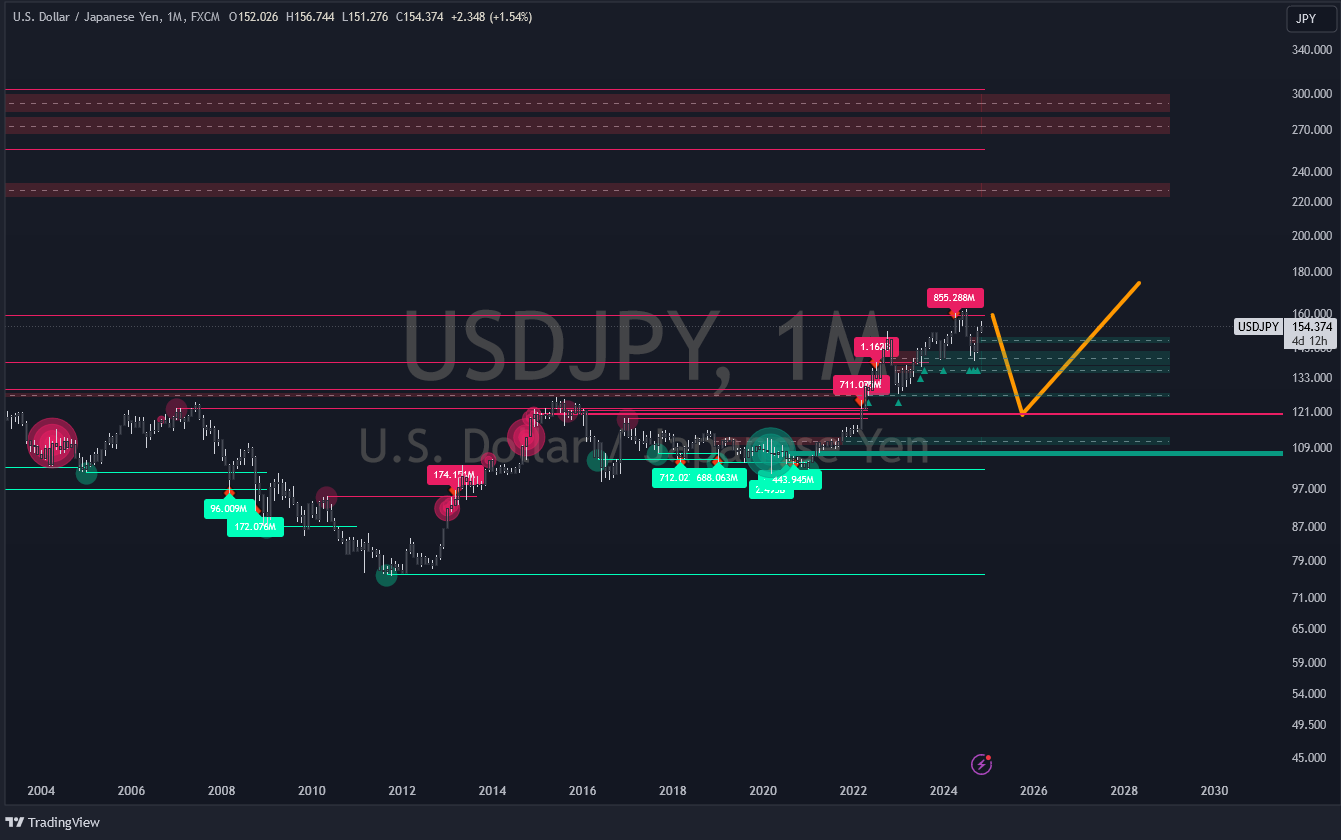

Macroeconomic Policies: Navigating a Deflationary Bust Global markets are bracing for a deflationary bust, driven by:

Tightening Monetary Policies: Central banks remain hawkish, with limited room for rate cuts in the short term.

Government Spending: Increased fiscal expenditures may lead to higher debt burdens, pressuring economies into stagflation-like conditions. Key events to watch include the Federal Reserve's next rate decision and fiscal stimulus announcements, which will likely dictate market sentiment for months to come.

Crypto Market Outlook: Opportunities Amid Volatility The crypto market remains a beacon of innovation and opportunity. Let’s break down the key trends:Bitcoin Miners and Market Impact: Miners are playing a pivotal role, with increased activity signaling potential accumulation phases. Monitoring miner wallet flows and their selling behavior can offer early clues to price movements.

Ethereum and Altcoin Dynamics: Ethereum’s dominance continues to grow, with Layer 2 solutions like Polygon and Arbitrum driving adoption. Altcoins like Solana and Polkadot are gaining traction, making them essential to watch for breakout patterns. Total Market Cap: With a target of $3.3 trillion by mid-2024, the crypto market is positioned for exponential growth.

Bitcoin dominance is expected to decline slightly as altcoins take the spotlight, creating significant opportunities for diversified portfolios.

Actionable Opportunities for Investors

For Crypto Traders:

Short-term Bitcoin target: $115,000.

Ethereum target: $5,300.

Accumulate altcoins like xrp,xlm,sologenic,algo,Solana, Cardano, and Polkadot during dips.

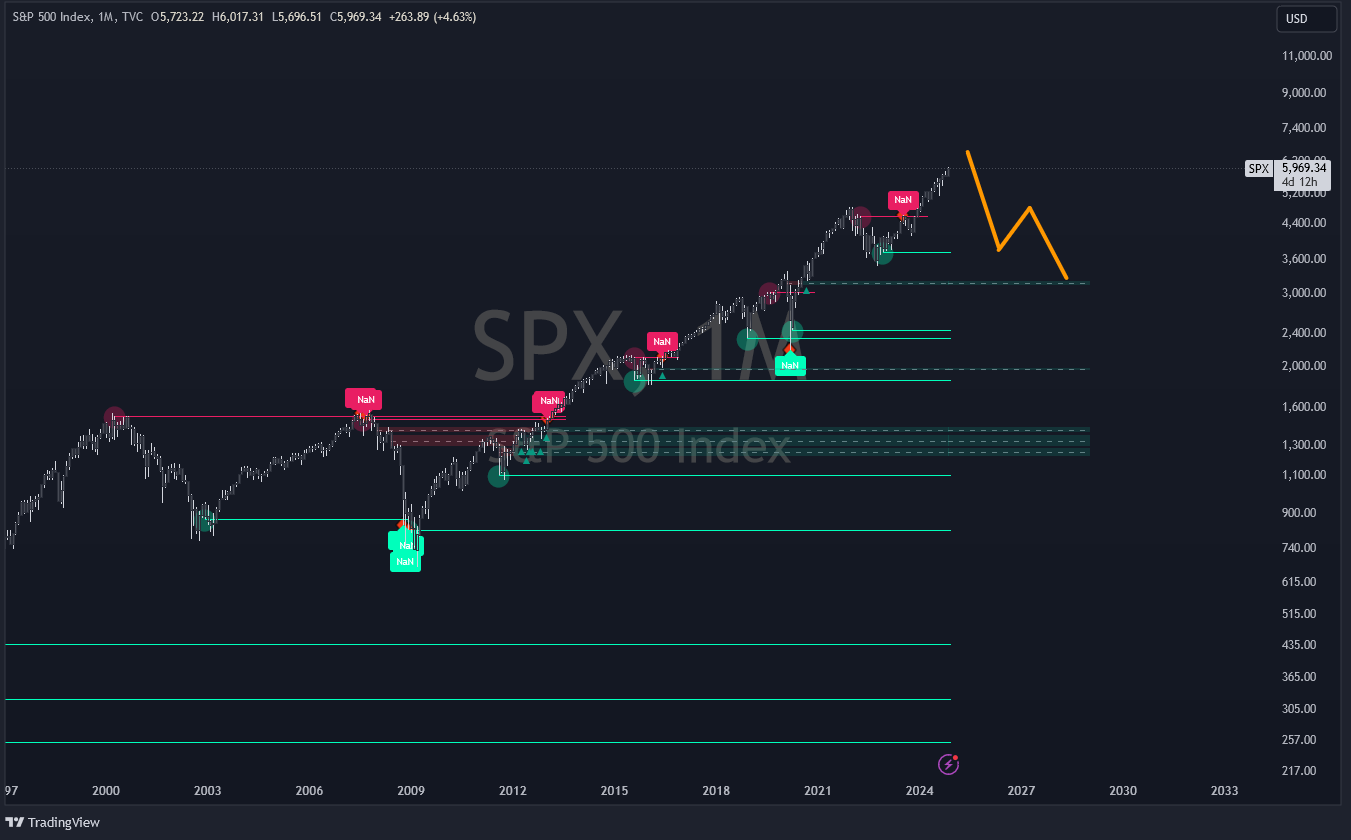

For Stock Market Investors:

S&P 500 resistance: 6,400. Watch for correction triggers.

Monitor tech-heavy indices for early signs of volatility.

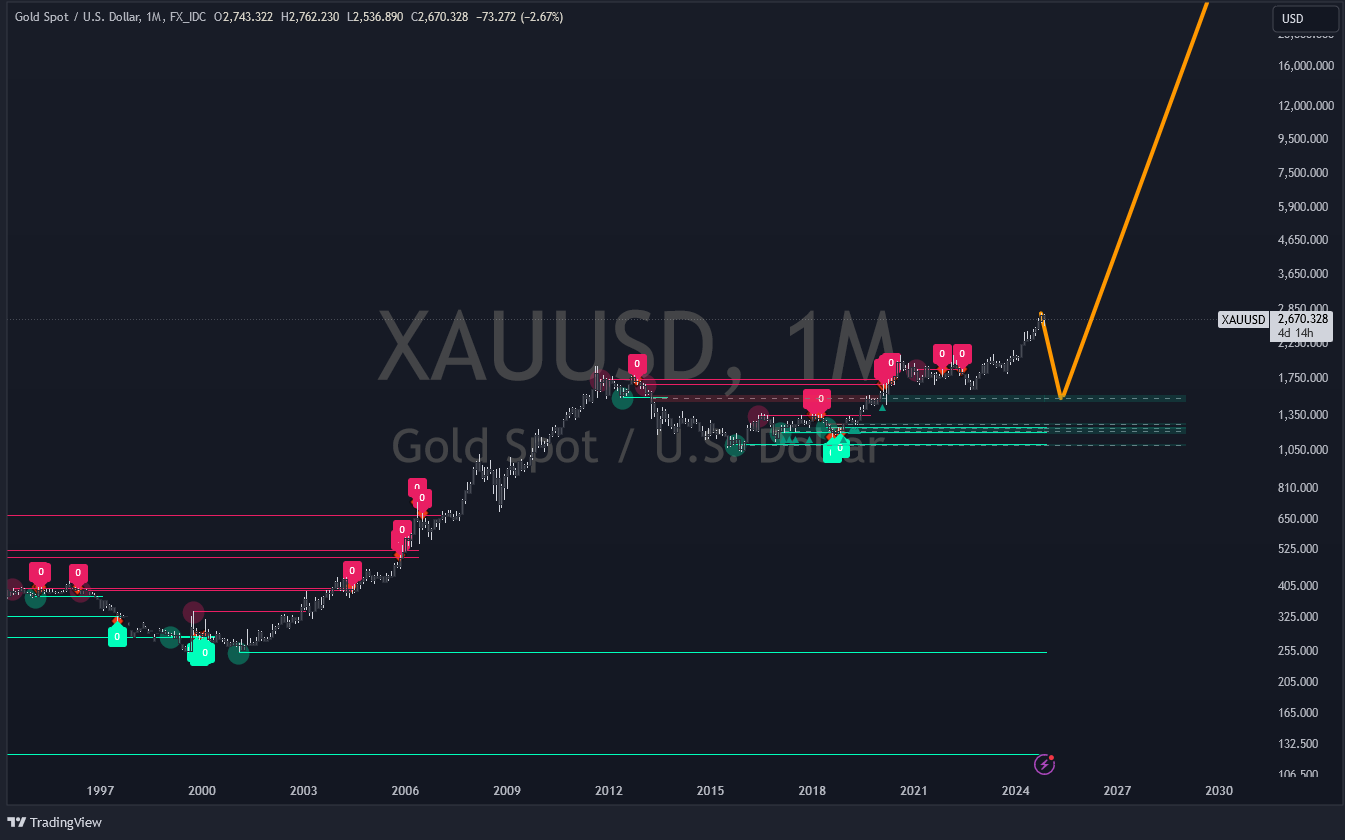

For Gold Enthusiasts:

Accumulate near $1,900–$1,850 for long-term gains targeting $30,000.

Looking Ahead: Key Dates to Remember

Next Federal Reserve Decision: December 12, 2024.

Global Inflation Reports: January 2025.

That’s it for the weekly analysis! Thank you for tuning in to algo-fund.com for your daily market insights. For detailed charts, tools, and strategies, visit our website. See you next time!