XRP MARKET UPDATE 09.JAN.2025

Good morning, traders! Welcome to your daily XRP market update. Today is January 9th, 2025, and XRP/USDT is trading at $2.31. Let's dive into the key highlights and forecast for the day!

Starting with the technicals, XRP remains bullish on the daily timeframe. The price is well above the 50-day moving average at $2.17 and the 200-day moving average at $0.97, signaling strong upward momentum. The RSI is currently at 57, indicating neutral conditions with room for further upside.

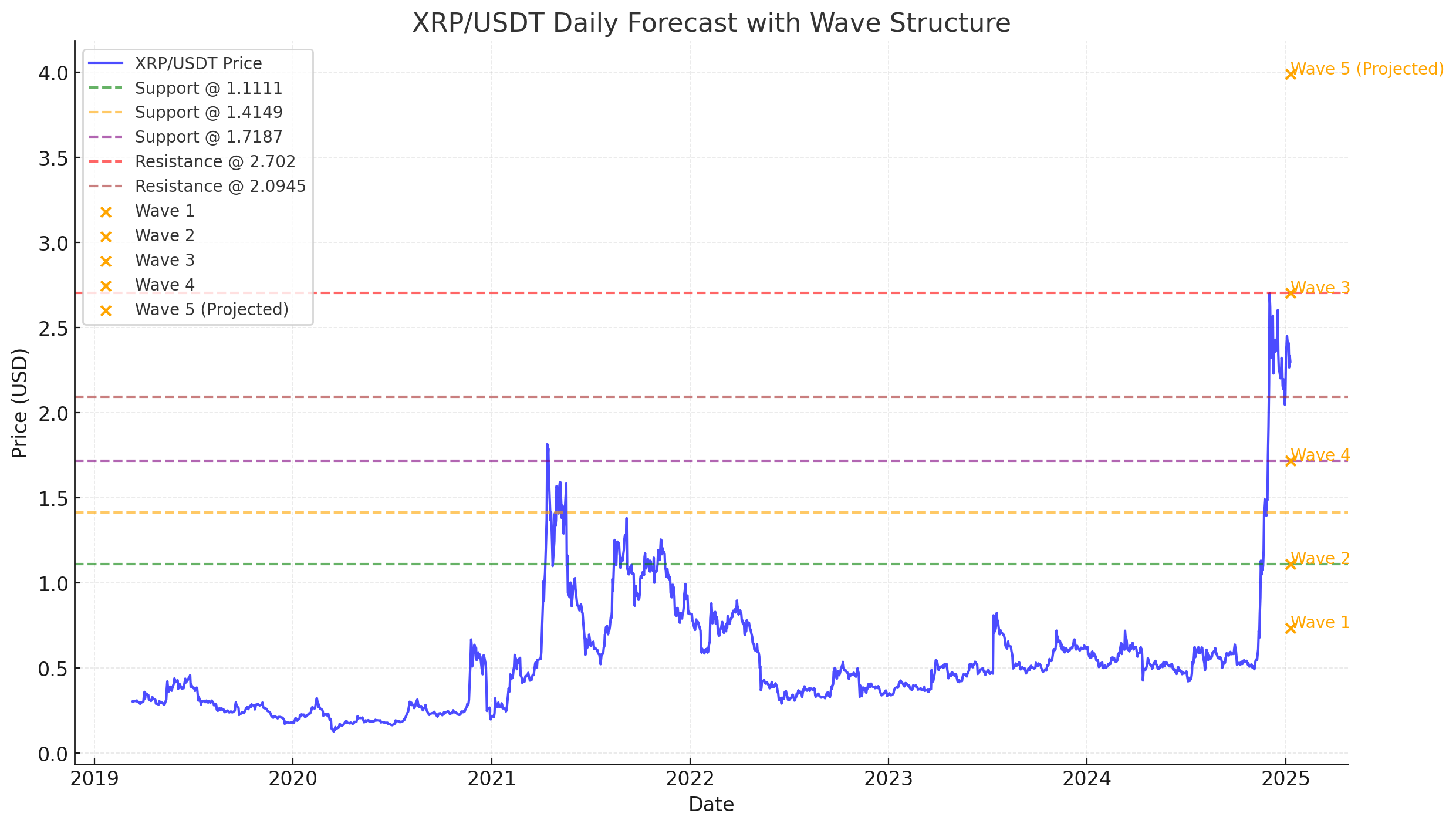

Let’s take a closer look at key levels.

- Support Levels: $1.11, $1.41, and $1.71, aligning with major Fibonacci retracements.

- Resistance Levels: $2.70, the recent high, and $2.09, the 0.236 Fibonacci level."

These levels will guide us in identifying potential entry and exit points.

Now, let’s talk about the Elliott Wave structure.

- Wave 3 recently completed at $2.70, followed by a retracement to Wave 4 at $1.71.

- Wave 5 is projected to reach $3.98, which aligns with our bullish outlook for the coming weeks.

This suggests a potential continuation of XRP's rally after a short-term consolidation.

Switching to order flow and on-chain metrics, here’s what we see:

- Whales have increased their holdings by 4.5% in the last week, showing confidence in XRP’s bullish trend.

- Aggregated heatmaps highlight strong buy-side liquidity around $2.00 and $1.80.

- Meanwhile, significant sell walls are building near $2.70 and $3.00, marking key profit-taking zones.

Finally, let’s look at the forecast.

- The next bottom is expected around $1.80 to $1.90, likely on January 11th at 12:00 GMT+1.

- The next top is projected at $3.20 to $3.50, potentially reaching this level on January 18th at 14:00 GMT+1.

In summary, XRP is in a strong Markup Phase, with support at $1.80 and resistance at $2.70. Whales and on-chain activity support further upside, and the Elliott Wave structure points to $3.98 as a key target.

Thanks for tuning in to your daily XRP market update. Don’t forget to like, subscribe, and hit the notification bell for tomorrow’s forecast. Happy trading, and I’ll see you again soon!