XRP MARKET UPDATE 19.DEC.2024

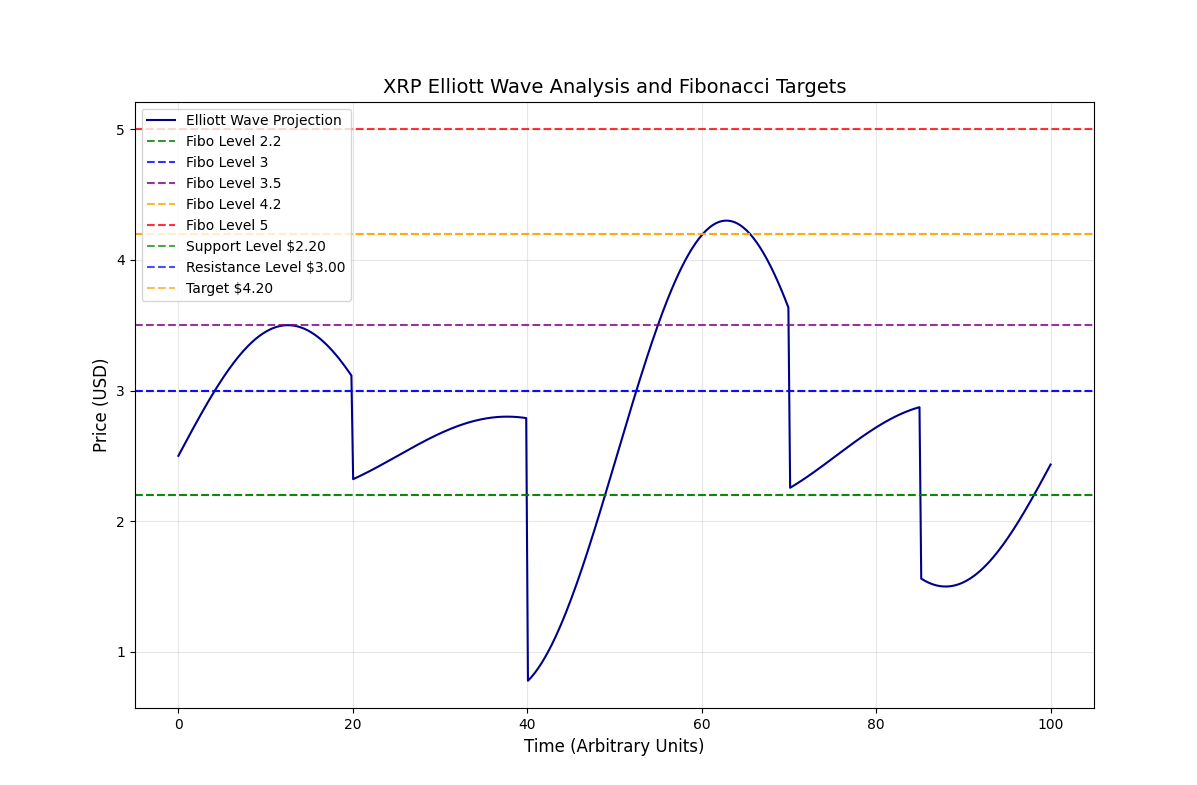

Welcome to today's XRP analysis and forecast. As we examine XRP/USDT, the focus will be on technical indicators, Elliott Wave structures, and insights derived from higher timeframes to capitalize on this bullish momentum. The current price of XRP is $2.3628 as of December 19, 2024, at 7:46 AM GMT+1. With a clear upward trajectory, we will provide actionable strategies and targets for accumulation and profit-taking.

XRP has demonstrated a remarkable rally over recent months. On the weekly chart, we observe a transition from consolidation phases to breakout zones, driven by increased volume and whale activity. The market sentiment has shifted towards bullishness, supported by macroeconomic factors and network adoption milestones.

Technical Analysis

1. Elliott Wave Analysis

Current Wave Structure:

- Wave 1: Initiated from $0.50, reaching $1.20, characterized by increased retail participation.

- Wave 2: Retracement to $0.85, a 61.8% Fibonacci level, providing a key accumulation zone.

- Wave 3: The most impulsive phase, extending from $0.85 to the recent high of $2.80.

- Wave 4: A shallow correction to $2.20, aligning with the 38.2% Fibonacci retracement.

- Wave 5: Currently forming, with projections targeting $3.50-$4.20 as the final impulse wave.

2. Indicators and Patterns

- RSI: On the daily timeframe, the RSI remains in the overbought zone but shows divergence, signaling a potential minor pullback before further continuation.

- MACD: Bullish crossovers observed on 4-hour and daily charts, reinforcing upward momentum.

- Volume Profile: Significant accumulation between $1.50 and $2.00, suggesting strong institutional interest.

- Market Cipher: Green dots on lower timeframes indicate imminent bullish continuation.

Key Levels and Targets

Support Zones:

- $2.20: Immediate support from the current price, aligning with the Wave 4 correction.

- $2.00: Psychological level and previous breakout zone.

- $1.50: Major institutional buy zone observed on the weekly chart.

Resistance Zones:

- $3.00: Psychological barrier and Fibonacci extension level.

- $3.50-$4.20: Projected Wave 5 target range based on Elliott Wave theory.

- $5.00: Long-term target aligned with historical price patterns and macro-level resistance.

Strategy and Forecast

1. Short-Term Outlook (1 Week):

- Expect a minor pullback to $2.20-$2.00. This zone is ideal for adding positions, with a stop-loss at $1.85 to mitigate downside risk.

- Target $3.00 for short-term profit-taking, as it represents the next significant resistance.

2. Medium-Term Outlook (1 Month):

- Accumulate on dips towards $2.00, maintaining a bullish bias.

- Anticipate a rally to $3.50-$4.20, completing Wave 5. Partial profit-taking is advised within this range.

3. Long-Term Outlook (3-6 Months):

- Post-Wave 5 completion, expect a corrective ABC wave. The projected retracement is towards $2.50-$2.00, providing a new accumulation opportunity.

- Long-term targets extend to $5.00-$7.00, driven by increasing network utility and whale accumulation.

On-Chain and Derivatives Analysis

- Whale Activity: Recent data indicates large XRP transfers between wallets and exchanges, signaling accumulation.

- Open Interest: Futures OI shows a rising trend, supporting the bullish narrative.

- Funding Rates: Positive funding rates suggest strong market confidence.

Risk Management

- Maintain a stop-loss strategy, dynamically adjusting as price moves in your favor.

- Diversify between spot holdings and periodic profit-taking to lock in gains.

- Avoid over-leverage, focusing on capital preservation during corrective phases.

Conclusion

XRP is poised for significant upward movement, driven by technical, on-chain, and macroeconomic factors. By strategically entering on pullbacks and scaling out near key resistance levels, traders can maximize their gains during this bull run. Stay updated with regular analysis to adapt to market changes